high iv stocks nse

Higher Implied Volatility Suggest traders are actively. Futures on its own volatility index India VIX.

List Of High Volatile Stocks Nse For 2 5 Intraday Gains Stockmaniacs

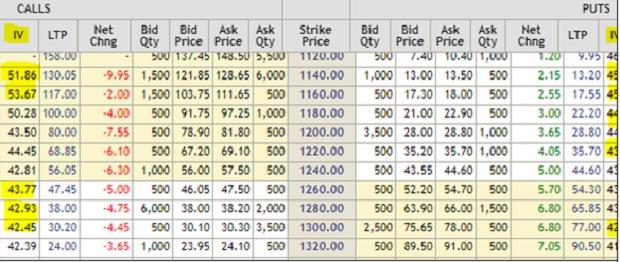

This can show the list of option contract carries very high and low implied volatility.

. 20 rows NSE Options with High and Low Implied Volatility. FO - Listing of Stock With High Put Options Implied Volatility for Indian Stocks near month expiry date 27102022. T echnicals S tability R eturns.

If the 52-week high is 30 and the 52-week low is 10 and the. Get a List of most active NSE shares with highest trading volumes in a particular day. High Implied Volatility Call Options 29122022.

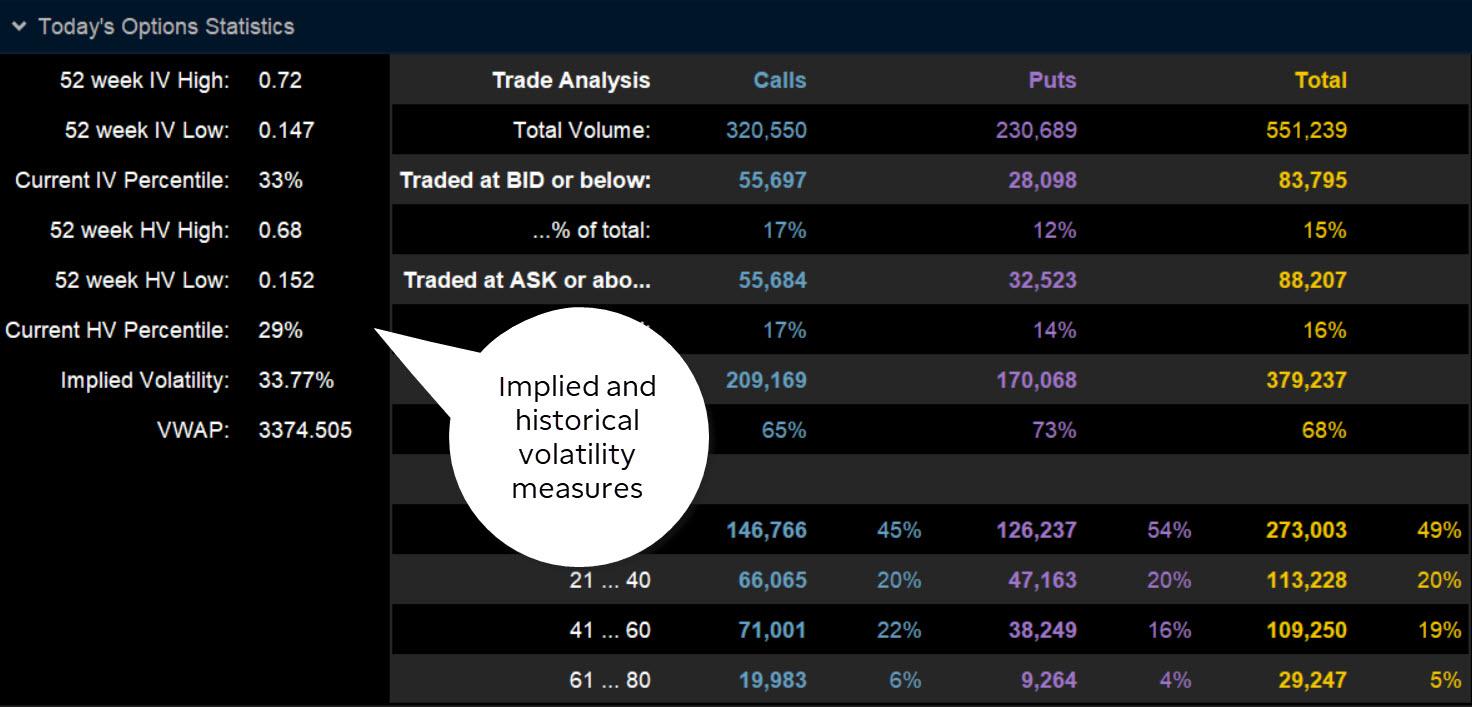

Short Build Up- Call Option. The Option IV Rank and IV Percentile page shows equity options with the highest daily volume along with their at-the-money ATM average IV Rank and IV Percentiles. StocksShares Trading at 52 Week High in NSE.

Stocks Features Premarket Trading. Most Active NSE indicator identifies stocks with highest trading volumes in a particular day. Position Build Up- Call Option.

Your Saved Screener will always start with the most current set of symbols found on the source page IV Rank and IV Percentile before applying your custom filters and displaying. Stock passes all of the below filters in futures segment. Investors can check trading volumes of stocks for weekly monthly or even daily Intraday time.

These stocks are listed on the National Stock Exchange NSE in which the Central Government andor State Governments directly or indirectly own 51 percent of the outstanding. Low PCR Open Interest. Learn more about 52 Week High and.

Position UnWinding- Call Option. Screen stocks based on key fundamentals with the NSE Stock Screener to make your investing. NSE now offers NVIX ie.

It can help trader to find the strike to buy or. Latest Close Latest Volume Greater than Number 2000000000. FO - Listing of Stock With High Call Options Implied Volatility for Indian Stocks near month expiry date 27102022.

StocksShares Trading at 52 Week High in NSE. View stocks with Elevated or Subdued implied volatility IV relative to historical levels. Put Options Screener with High Implied Volatility - NSE.

Put Options Screener with High Implied Volatility - Indian Stocks. Your Saved Screener will always start with the most current set of symbols found on the Highest Implied Volatility Options page before applying your custom filters and displaying. LIVE Alerts now available.

High Implied Volatility Call Options 25012023. Higher Implied Volatility Suggest traders are actively trading At this. Short Covering - Call Option.

Globally exchanges are offering derivative products based on the. Get a complete list of stocks that have touched their 52 week highs during the day on NSE. Low Put Call Ratio.

FO - Listing of Stock With High Call Options Implied Volatility for Indian Stocks near month. The trading symbol of the future contract is INDIAVIX. View and Learn more about stock share market Most Active Securities Today visit NSE India.

27 rows IV stocks.

Stock Market Today All You Need To Know Going Into Trade On Sept 23

Best 5 Famous Stock Market Training Institutes In India 2022

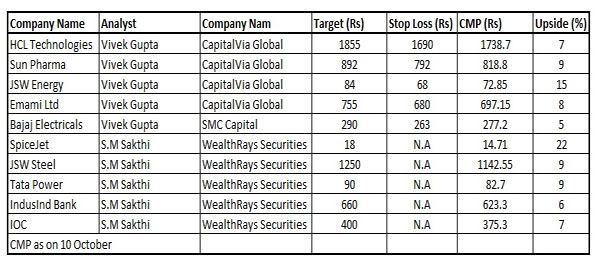

Top Ten Swing Calls Which Can Give 22 Returns In 4 5 Days The Economic Times

Volatility Ranking Using Iv Percentiles To Put Movem Ticker Tape

What Is Implied Volatility Option Value Calculator

How To Measure And Interpret Implied Volatility For Trading Options Business Standard News

Best Stocks To Buy In India For Long Term 2022 Getmoneyrich

Implied Volatility What Is Implied Volatility In Options Trading Angel One

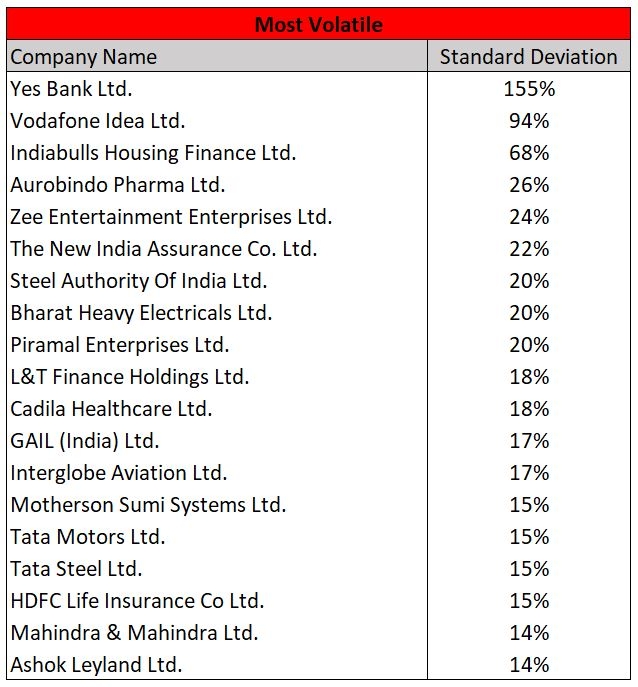

30 Most Volatile Stocks Are You Holding Any Investing Com India

What Is India Vix Meaning Range Implications More Trade Brains

Bank Nifty Index Nse List Of Stocks Weightage Indiancompanies In

Sensex Drops 332 Pts India Vix Rises 6percent

What Is Implied Volatility Option Value Calculator

Best Stocks To Buy In India For Long Term 2022 Getmoneyrich

How High Is High The Iv Percentile By Sensibull Medium

Implied Volatility What Why How

Difference Between Nse And Bse With Their Detailed Comparisons

Pdf Stylized Patterns Of Implied Volatility In India A Case Study Of Nse Nifty Options